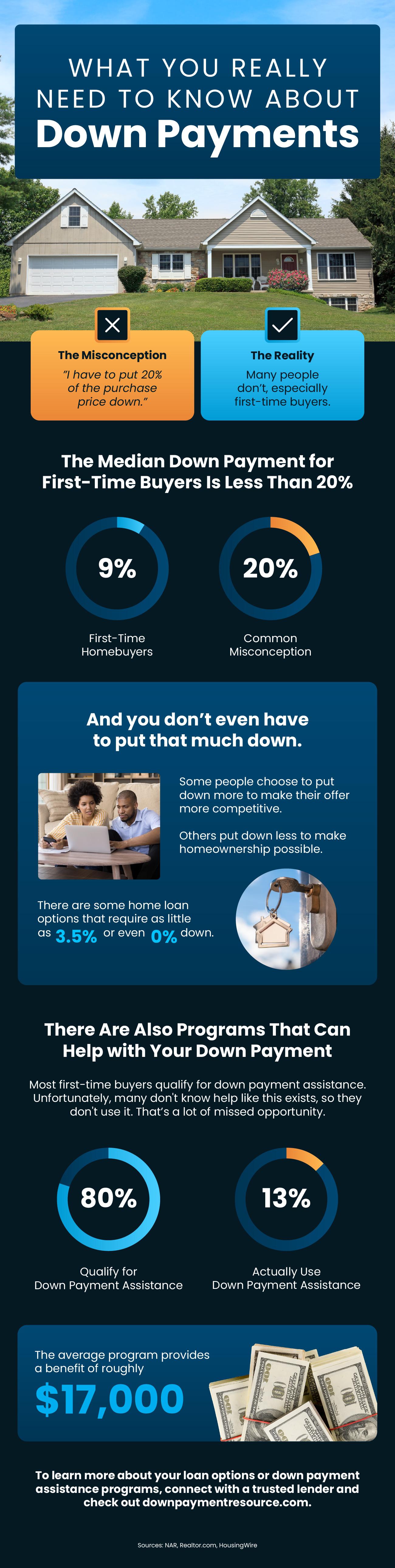

What You Really Need To Know About Down Payments

What You Really Need To Know About Down Payments

Some Highlights

- There’s a misconception going around that you have to put 20% of the purchase price down when you buy a home. But the truth is, many people don’t put down that much unless they’re trying to make their offer more competitive.

- And if you want to give your savings a boost, look into down payment assistance. Most first-time buyers qualify and the typical benefit is $17,000.

- To learn more about your loan options or down payment assistance programs, connect with a trusted lender and check out downpaymentresource.com.

Categories

Recent Posts

Why So Many Homeowners Are Downsizing Right Now

Top 2026 Housing Markets for Buyers and Sellers

You May Not Want To Skip Over That House That’s Been Sitting on the Market

Mortgage Rates Recently Hit a 3-Year Low. Here’s Why That’s Still a Big Deal.

Why Rising Foreclosure Headlines Aren’t a Red Flag for Today’s Housing Market

Home Updates That Actually Pay You Back When You Sell

The #1 Regret Sellers Have When They Don’t Use an Agent

The Credit Score Myth That’s Holding Would-Be Buyers Back

Expert Forecasts Point to Affordability Improving in 2026

Thinking about Selling Your House As-Is? Read This First.

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "